Posted: May 9th, 2016 -

Latest market report: The Online Art Market is Booming

Art insurance company Hiscox recently released its fourth annual report detailing the state of the online art market. Their findings (with data gathered by art market research firm ArtTactic), confirm indications in last month’s TEFAF report that the global art market for online sales are at an all-time high.

Artsy added to the findings with an good article about “The Five Takeaways That You Need to Know”. Be sure to read the article and full report, but here are some of their key points.

“Online sales jumped 24% last year, to a high of $3.27 billion.

Fueled by the expansion of a number of online platforms, the online art market has grown from $1.57 billion in 2013, to $2.62 billion in 2014, to last year’s figure of $3.27 billion. Such growth prompted Hiscox to revise its forecast for the sector up 5%, from the 19% found in previous editions of the report to 24% this year. If growth continues at this rate, the online art market will be worth around $9.58 billion by the end of the decade. The report notes that their growth outlook of 24% for the online art market is in line with the general online luxury goods sector, which has grown 27% year over year from 2009 to 2014. Due to the fact that Hiscox’s numbers are based off publicly available sales info and estimates of the “main online art and collectible sales platforms” they are assumed to be a conservative indication of growth. Also not counted is the entirety of the online art market in China.

Online art market buyers are likely to return, with 92% saying they would buy the same amount of—or more—work online in the next 12 months.

Of those surveyed, 48% of art buyers said they would be buying more art and collectibles online in the next 12 months, while 44% said they would buy the same amount and 8% said they would buy less (a drop of 6% from last report’s 14%).

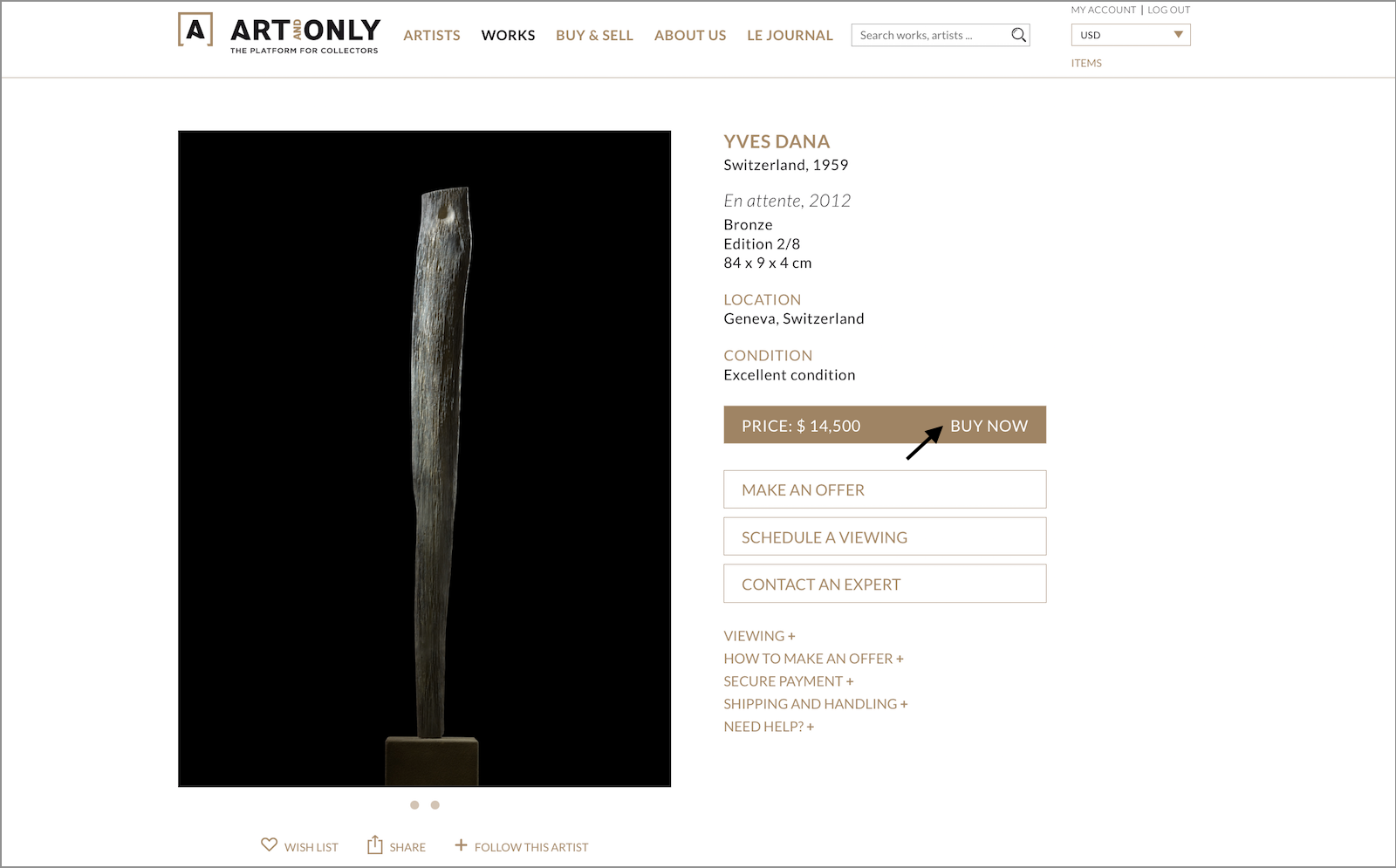

Online marketplaces are eclipsing online auctions as the favored method of purchasing art, indicating that buyers are increasingly interested in fixed-price options.

Although all online platforms have seen an increase in the number of buyers active on their sites in the past year, the largest boost was in the realm of “online art marketplaces.” Compared to 21% in 2015, 41% of this year’s respondents had purchased art from online marketplaces. These platforms are even more popular among buyers between the ages of 18 and 35, where just over half of respondents are purchasing art through online marketplaces. This marks the first time online marketplaces have surpassed online auctions in popularity, albeit only slightly—37% of buyers surveyed for the 2016 report had purchased art via auction. These numbers seem to indicate a growing preference for “buy now” options, as opposed to timed or live auctions.

Online art sales are joining the migration from desktop to mobile.

There’s been a shift in the way we surf the web—just last month, people in the U.S. spent more than a trillion minutes online with mobile devices, close to double the amount of time they spent on desktop computers. This trend is reflected in the Hiscox report, which demonstrates a growing reliance on smartphones and other devices to access online art platforms.

Among Generation Y buyers—also known as millennials—19% made their first-ever purchase online, up from 9% last year.

Besides highlighting the important growth that will come from this age group, Hiscox notes some interesting things about habits of the Gen Y cohort. For one thing, they’re emotional—92% citing some kind of feeling as a motivating factor to buy art. They haven’t entirely escaped being bitten by the finance bug, of course, with 57% also citing “investment” as a purchasing reason, followed by “identity/status” (44%) and then “social” (39%). They also tend to gravitate towards fine art, with 81% responding that they buy art online. The next closest category is “decorative art and design,” at 61%. Of this technology-savvy generation, 46% of those surveyed said that they purchase art online.

Via: Artsy.net

Comments